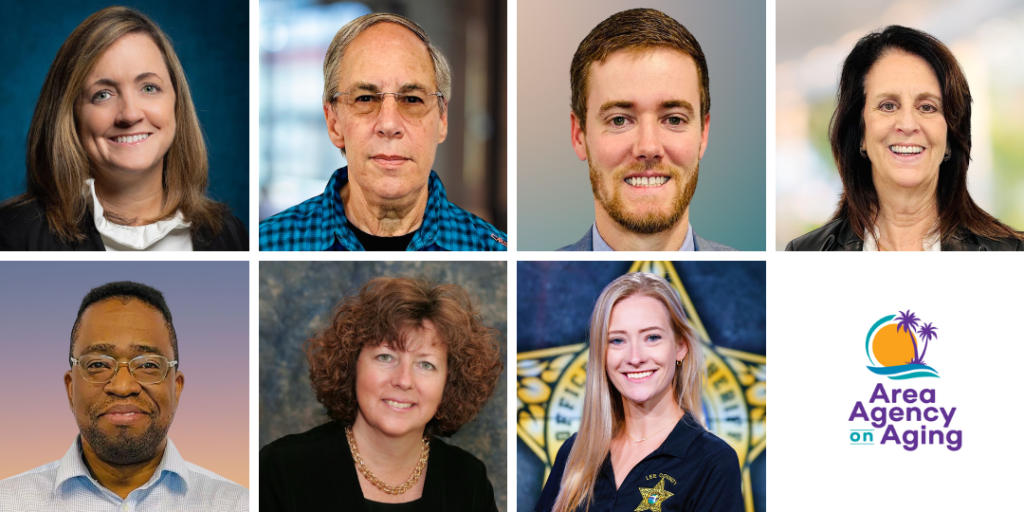

The board of directors of the Area Agency on Aging for Southwest Florida (AAASWFL), a nonprofit serving older adults and adults with disabilities, announced four appointments and welcomed three new board members. Dr. Lesley Clack will serve as chair, Daniel I. Katz as vice chair, Garrett Anderson as treasurer and Pamela D. Keller as secretary. The new board members are Jaha Cummings, Dr. Denise McNulty, and Victoria Staryk.

“We are pleased to welcome our three new board members,” said Maricela Morado. “They will bring valuable insights and will add to the strategic direction our new board leadership are following.”

Dr. Clack has served as a board member since October 2022 and has extensive experience and expertise with the aging population. She is currently an associate professor and chair of the Department of Health Sciences at Florida Gulf Coast University. She also serves as program director for the Bachelor of Science in health administration and Master of Science in health sciences programs. Dr. Clack has been funded by the Department of Health and Human Services to provide evidence-based wellness services to senior adults for the past five years. She regularly presents her work at regional and national conferences on aging.

Dr. Clack holds a Doctor of Science degree in health systems management from Tulane University School of Public Health and Tropical Medicine, a Master of Science degree in counseling psychology from the University of West Alabama, and a Bachelor of Science degree in biological science from the University of Georgia. She is also Certified in Public Health (CPH) by the National Board of Public Health Examiners.

Katz has served as a board member since February 2021. Most recently he was CEO of Jewish Senior Life (JSL) in Rochester, New York, which provides a continuum of health care and senior living from independent and assisted-living apartments to transitional and long-term care. Prior to JSL, he served as vice president of post-acute services at Stamford Health System (SHS) in Stamford, Connecticut serving in various executive positions in long-term care and senior services.

He has served on numerous boards and as chair in both New York and Connecticut related to senior health, Alzheimer’s, aging and long-term care. He earned a bachelor’s in Geography from Syracuse University, and a bachelor’s degree in health services administration from Quinnipiac University in Hamden, Connecticut.

Anderson has served as a board member since October 2021. Currently, he is practice director at NCH Healthcare System, a not-for-profit health care system located in Naples, Florida. Before joining NCH, Anderson had a career as a professional baseball player with the Tampa Bay Rays.

He earned a bachelor’s and a master’s degree in health care administration management from Florida Gulf Coast University.

Keller has served as a board member since August 2016.She is president of Keller Law Office, P.A. in Punta Gorda, Florida and has more than 30 years of experience focusing on elderly law and civil litigation in both Florida and New York. As former chair of the Florida Council for Public Policy representing Florida’s chapters of the Alzheimer’s Association, and as chair of the Legislative Committee for Florida State Guardianship Association, she has lobbied on the state and federal levels on behalf of those affected by Alzheimer’s disease and other cognitive impairments.

As a member of the Board of the Arts & Humanities Council of Charlotte County, she chaired the Council’s Advocacy Committee and founded the Art Therapy Training Program, Expressions from Beautiful Minds. She was also named OCEAN’s 2013, Sunflower Award Recipient which recognizes people who have made a significant contribution as an advocate for the elderly in Charlotte County.

She obtained her JD from St. John’s University School of Law and a Bachelor of Arts from the University of Wisconsin.

New Members

Cummings is the founder of Blanchard House Institute, an organization established to operate in conjunction with the Blachard House Museum’s educational, research and outreach. He also founded the Black Wall Street Trail that celebrates the legacy of the golden age of historic African America Business district impacted by urban renewal and the Seminole Maroon Freedom Trail, a national public-private-philanthropic partnership across industries to build an economic and cultural trail honoring Seminole Maroon quest for freedom. He lived in Asia for 20 years and was a consultant to governmental and high-level executives on market analysis for international health care companies.

He served three terms as a Punta Gorda City Councilman and completed all levels of certification from the Florida League of Cities University’s Institute of Elected Municipal Officials. He is a member of Leadership Florida and serves on numerous boards. Cummings has been involved in various committees and councils, including the Florida Freight Advisory Committee and the Governor’s Taskforce on Abandoned African American Cemeteries. He has also served as Treasurer for the Southwest Florida Regional Planning Council and Vice-Chair of the Charlotte County Tourism Development Council. In addition, he is the President of the Cultural Heritage Center of Southwest Florida. He is a commercial real estate practitioner and investment banker.

Cummings earned his degree in Asian studies from Dartmouth College.

McNulty has 30 years of experience in health care, serving in various administrative, clinical, and teaching roles. Originally from Philadelphia, she relocated to Southwest Florida in 2000.

Currently she is the administrator/CEO of Willough at Naples, a behavioral health hospital specializing in the treatment of dual diagnosis disorders and mental health illnesses in Lely, Florida. She also maintains a private practice in Naples, where she provides therapy for individuals, couples, and families as an advanced practice registered nurse. She is board certified by the American Nurses Credentialing Center as a psychiatric and mental health nurse.

She most recently served as the Director of Behavioral Health for the NCH Healthcare System, Clinical Education Specialist and Mental Health/Addictions Subject Matter Expert for Lee Health, and Chief Clinical Officer for the Baker Senior Center Naples.

She earned a Doctor of Nursing Practice degree from Duquesne University and a Master of Science in Nursing Degree from the University of Pennsylvania. She has a Bachelor of Science degree in nursing from Holy Family University in Philadelphia. In December 2016 she graduated from The Wharton School, University of Pennsylvania Nursing Leaders Program.

Staryk is currently the Central District’s Crime Prevention Practitioner in the Community Response Unit at the Lee County Sheriff’s Office. In her role, she keeps Lee County residents informed of important community news.

She is currently pursuing a degree in business management from Florida SouthWestern State College.

Posted: April 30, 2024 by Leave a Comment

Spot the Signs of Elder Abuse

Abuse can happen to any older person. Learn about the different types of abuse, how to recognize the signs, and where to get help.

Source: NIIH.org

There are different types of abuse:

Be alert to the following signs:

Depressed, confused or withdrawn

Isolated from friends and family

Unexplained bruises, burns or scars

Appear dirty, underfed, dehydrated, over or under medicated

Bed sores

Changes in banking or spending patterns

Last Updated: August 13, 2025 by Leave a Comment

Medicare Minute: Preparing for Future Health Care Needs

It’s important to have a plan ahead of time to avoid disagreements around treatment issues and to ensure your wishes are honored if you are incapacitated. Advance directives, living wills, health care proxies, and powers of attorney can help ensure that decisions made on your behalf meet your needs and preferences.

Important documents to have include:

For detailed tips on preparing these documents download the “Preparing for Future Health Care Needs” handout by the Medicare Rights Center.

To understand how Medicare covers hospice and for answers to other Medicare coverage questions, contact your State Health Insurance Assistance Program (SHIP). You can visit www.shiphelp.org or call your local SHINE Medicare Counselors at 1-866-413-5337.

Last Updated: August 13, 2025 by Leave a Comment

Celebrating Older Americans Month: Powered by Connection

Established in 1963, Older Americans Month (OAM) is celebrated every May. Led by a federal agency, the Administration for Community Living (ACL), OAM is a time to recognize older Americans’ contributions, highlight aging trends, and reaffirm commitments to serving the older adults in our communities.

This year’s theme, “Powered by Connection,” focuses on the profound impact that meaningful connections have on the well-being and health of older adults — a relationship underscored by the U.S. Surgeon General’s Advisory on the Healing Effects of Social Connection and Community.

It’s not just about having someone to chat with, it’s about the transformative potential of community engagement in enhancing mental, physical, and emotional well-being. By recognizing and nurturing the role that connectedness plays, we can mitigate issues like loneliness, ultimately promoting healthy aging for more Americans.

How can community groups, businesses, and organizations mark OAM?

What can individuals do to connect?

For free local events and services, visit our event calendar.

For more information, visit the official OAM website and follow ACL on X, Facebook, and LinkedIn. Join the conversation on social media using the hashtag #OlderAmericansMonth.

Last Updated: August 13, 2025 by Leave a Comment

April is National Volunteer Month

Make a difference by helping others navigate Medicare, join our team!

Medicare can be complicated, but as a trained volunteer you can help by answering questions and providing personalized guidance to members of your community as they enroll in Medicare for the first time, review plan options, or troubleshoot problems. SHIP (State Health Insurance Assistance Program) provides unbiased support to Medicare beneficiaries and their families so they can make informed decisions about their care and benefits.

Become a volunteer, help people in your community navigate Medicare. For some, it offers a chance to give something back to their community. For others, it provides an opportunity to develop new skills or build on existing experience and knowledge. In Florida your local SHIP program is SHINE (Serving Health Insurance Needs of Elders). To learn more about volunteering with SHINE, click here.

During the month of April, we’ll be celebrating our SHINE volunteers. We look forward to sharing more in our May newsletter.

Last Updated: August 13, 2025 by Leave a Comment

Medicare Minute: Medicare for Federal Employees and Retirees

Whether to enroll in Part B or use FEHB as primary coverage is a personal decision, based on your individual circumstances. You should look at the costs and benefits of each insurance plan and make the choice that’s best for you.

Federal Employee Health Benefits (FEHB)

When you become Medicare-eligible, you have a few options:

Keep FEHB and turn down Medicare.

Keep FEHB and enroll in Medicare.

The two will work together to cover your health care costs, but you will owe premiums for both.

Disenroll from FEHB and enroll in Medicare.

You might not be able to enroll in FEHB again in the future if you change your mind.

For a full list of questions to ask yourself when choosing the option that is best for you and more on identifying billing errors download this helpful handout by the Medicare Rights Center.

Who to contact for more information:

• Contact your State Health Insurance Assistance Program (SHIP) if you want to discuss your Medicare enrollment options with a Medicare counselor.

• Contact your Senior Medicare Patrol (SMP) if you may have experienced Medicare fraud, errors, or abuse. In Southwest Florida it is 866-413-5337 or email shineinfo@aaaswfl.org.

• Contact the U.S. Office of Personnel Management (OPM) if you’re a federal employee or retiree and want to learn more about FEHB. You can call 317-212-0454 or visit www.opm.gov/healthcare-insurance.

• Contact United States Postal Service (USPS) if you are a USPS employee, retiree, or eligible family member and need more information on PSHB. Current employees can visit www.liteblue.usps.gov and retirees can visit www.keepingposted.org.

The Medicare Rights Center is the author of portions of the content in these materials but is not responsible for any content not authored by the Medicare Rights Center. This document was supported, in part, by grant numbers 90SATC0002 and 90MPRC0002 from the Administration for Community Living (ACL), Department of Health and Human Services, Washington, D.C. 20201. Grantees undertaking projects under government sponsorship are encouraged to express freely their findings and conclusions. Points of view or opinions do not, therefore, necessarily represent official Administration for Community Living policy. [April 2024]

Last Updated: August 13, 2025 by Leave a Comment

Area Agency on Aging for SWFL Board of Directors Announces Four Appointments and Welcomes Three New Members

The board of directors of the Area Agency on Aging for Southwest Florida (AAASWFL), a nonprofit serving older adults and adults with disabilities, announced four appointments and welcomed three new board members. Dr. Lesley Clack will serve as chair, Daniel I. Katz as vice chair, Garrett Anderson as treasurer and Pamela D. Keller as secretary. The new board members are Jaha Cummings, Dr. Denise McNulty, and Victoria Staryk.

“We are pleased to welcome our three new board members,” said Maricela Morado. “They will bring valuable insights and will add to the strategic direction our new board leadership are following.”

Dr. Clack has served as a board member since October 2022 and has extensive experience and expertise with the aging population. She is currently an associate professor and chair of the Department of Health Sciences at Florida Gulf Coast University. She also serves as program director for the Bachelor of Science in health administration and Master of Science in health sciences programs. Dr. Clack has been funded by the Department of Health and Human Services to provide evidence-based wellness services to senior adults for the past five years. She regularly presents her work at regional and national conferences on aging.

Dr. Clack holds a Doctor of Science degree in health systems management from Tulane University School of Public Health and Tropical Medicine, a Master of Science degree in counseling psychology from the University of West Alabama, and a Bachelor of Science degree in biological science from the University of Georgia. She is also Certified in Public Health (CPH) by the National Board of Public Health Examiners.

Katz has served as a board member since February 2021. Most recently he was CEO of Jewish Senior Life (JSL) in Rochester, New York, which provides a continuum of health care and senior living from independent and assisted-living apartments to transitional and long-term care. Prior to JSL, he served as vice president of post-acute services at Stamford Health System (SHS) in Stamford, Connecticut serving in various executive positions in long-term care and senior services.

He has served on numerous boards and as chair in both New York and Connecticut related to senior health, Alzheimer’s, aging and long-term care. He earned a bachelor’s in Geography from Syracuse University, and a bachelor’s degree in health services administration from Quinnipiac University in Hamden, Connecticut.

Anderson has served as a board member since October 2021. Currently, he is practice director at NCH Healthcare System, a not-for-profit health care system located in Naples, Florida. Before joining NCH, Anderson had a career as a professional baseball player with the Tampa Bay Rays.

He earned a bachelor’s and a master’s degree in health care administration management from Florida Gulf Coast University.

Keller has served as a board member since August 2016.She is president of Keller Law Office, P.A. in Punta Gorda, Florida and has more than 30 years of experience focusing on elderly law and civil litigation in both Florida and New York. As former chair of the Florida Council for Public Policy representing Florida’s chapters of the Alzheimer’s Association, and as chair of the Legislative Committee for Florida State Guardianship Association, she has lobbied on the state and federal levels on behalf of those affected by Alzheimer’s disease and other cognitive impairments.

As a member of the Board of the Arts & Humanities Council of Charlotte County, she chaired the Council’s Advocacy Committee and founded the Art Therapy Training Program, Expressions from Beautiful Minds. She was also named OCEAN’s 2013, Sunflower Award Recipient which recognizes people who have made a significant contribution as an advocate for the elderly in Charlotte County.

She obtained her JD from St. John’s University School of Law and a Bachelor of Arts from the University of Wisconsin.

New Members

Cummings is the founder of Blanchard House Institute, an organization established to operate in conjunction with the Blachard House Museum’s educational, research and outreach. He also founded the Black Wall Street Trail that celebrates the legacy of the golden age of historic African America Business district impacted by urban renewal and the Seminole Maroon Freedom Trail, a national public-private-philanthropic partnership across industries to build an economic and cultural trail honoring Seminole Maroon quest for freedom. He lived in Asia for 20 years and was a consultant to governmental and high-level executives on market analysis for international health care companies.

He served three terms as a Punta Gorda City Councilman and completed all levels of certification from the Florida League of Cities University’s Institute of Elected Municipal Officials. He is a member of Leadership Florida and serves on numerous boards. Cummings has been involved in various committees and councils, including the Florida Freight Advisory Committee and the Governor’s Taskforce on Abandoned African American Cemeteries. He has also served as Treasurer for the Southwest Florida Regional Planning Council and Vice-Chair of the Charlotte County Tourism Development Council. In addition, he is the President of the Cultural Heritage Center of Southwest Florida. He is a commercial real estate practitioner and investment banker.

Cummings earned his degree in Asian studies from Dartmouth College.

McNulty has 30 years of experience in health care, serving in various administrative, clinical, and teaching roles. Originally from Philadelphia, she relocated to Southwest Florida in 2000.

Currently she is the administrator/CEO of Willough at Naples, a behavioral health hospital specializing in the treatment of dual diagnosis disorders and mental health illnesses in Lely, Florida. She also maintains a private practice in Naples, where she provides therapy for individuals, couples, and families as an advanced practice registered nurse. She is board certified by the American Nurses Credentialing Center as a psychiatric and mental health nurse.

She most recently served as the Director of Behavioral Health for the NCH Healthcare System, Clinical Education Specialist and Mental Health/Addictions Subject Matter Expert for Lee Health, and Chief Clinical Officer for the Baker Senior Center Naples.

She earned a Doctor of Nursing Practice degree from Duquesne University and a Master of Science in Nursing Degree from the University of Pennsylvania. She has a Bachelor of Science degree in nursing from Holy Family University in Philadelphia. In December 2016 she graduated from The Wharton School, University of Pennsylvania Nursing Leaders Program.

Staryk is currently the Central District’s Crime Prevention Practitioner in the Community Response Unit at the Lee County Sheriff’s Office. In her role, she keeps Lee County residents informed of important community news.

She is currently pursuing a degree in business management from Florida SouthWestern State College.

Last Updated: August 13, 2025 by Leave a Comment

How to Recognize Scammers and Avoid Scams

The following tips were taken from the Protect Yourself from Government Imposter Scams handout (.pdf) prepared by the Social Security Administration as part of its annual #SlamtheScam campaign.

Recognize Scammers. They may:

How to avoid a scam:

Last Updated: August 13, 2025 by Leave a Comment

Medicare Minute: Part D Coverage Phases

The cost of your Medicare Part D-covered drugs may change throughout the year. If you notice that your drug prices have changed, it may be because you are in a different phase of Part D coverage. There are four different phases—or periods—of Part D coverage.

Deductible Period: Until you meet your Part D deductible, you are in the deductible period. During this time, you will pay the full negotiated price for your covered prescription drugs. While deductibles can vary from plan to plan, no plan’s deductible can be higher than $545 in 2024, and some plans have no deductible. You begin each new calendar year in the deductible.

Initial Coverage Period: After you meet your deductible, your plan will help pay for your covered prescription drugs. This is your initial coverage period. Your plan will pay some of the cost, and you will pay a copayment or coinsurance.

Coverage Gap: You enter the coverage gap when your total drug costs—including what you and your plan have paid for your drugs—reaches a certain limit. In 2024, that limit is $5,030. While in the coverage gap, you are responsible for 25% of the cost of your drugs. The coverage gap is also sometimes called the donut hole.

Catastrophic Coverage: In all Part D plans in 2024, you enter catastrophic coverage after you reach $8,000 in out-of-pocket costs for covered drugs. As of 2024, during this period, you owe no coinsurance or co-payments for the cost of your covered drugs for the remainder of the year. This puts a hard cap on your spending during the catastrophic phase of coverage. Before 2024, you paid 5% of the cost.

But what counts as an out-of-pocket cost? The out-of-pocket costs that help you reach catastrophic coverage include:

Costs that do not help you reach catastrophic coverage include monthly premiums, what your plan pays toward drug costs, the cost of non-covered drugs, the cost of covered drugs from pharmacies outside your plan’s network, and the 75% generic discount.

There are many types of pharmacy and prescription drug schemes. A few examples include:

Read your Medicare statements to check for errors or suspicious charges.

If you have any concerns about your Medicare statements or medications, contact your local Senior Medicare Patrol (SMP). Your SMP can help and report the potential fraud to the correct authorities. Contact information for your local SMP is on the last page of this document.

SHINE is your local SHIP and SMP contact. Call us at 1-866-413-5337 or email us at shineinfo@aaaswfl.org.

All the information in this blog post was taken from the Part D Coverage Phases handout.

The Medicare Rights Center is the author of portions of the content in these materials but is not responsible for any content not authored by the Medicare Rights Center. This document was supported, in part, by grant numbers 90SATC0002 and 90MPRC0002 from the Administration for Community Living (ACL), Department of Health and Human Services, Washington, D.C. 20201. Grantees undertaking projects under government sponsorship are encouraged to express freely their findings and conclusions. Points of view or opinions do not, therefore, necessarily represent official Administration for Community Living policy.

Posted: February 26, 2024 by Leave a Comment

Medicare Advantage Open Enrollment Period Ends March 31!

You can sign up for Medicare Part A and/or Medicare Part B during the General Enrollment Period if both apply:

This opportunity ends March 31, coverage will start the first day of the month after you enroll.

Medicare Advantage Open Enrollment Period (MA-OEP) is a single opportunity for someone currently enrolled in an advantage plan, that is not meeting their needs, to switch back to Original Medicare or another advantage plan. Deadline is March 31.

Call to speak with a SHINE Medicare Counselor at 866-413-5337.

search this site

popular pages

AAASWFL Programs & Services