Medicare Advantage Plans may try to tempt you with a variety of supplemental benefits—or things that Original Medicare can’t cover. These supplemental benefits can be extremely helpful, or they can end up being disappointing and misleading. In this Medicare Minute we’ll share what to look for when considering supplemental benefits and when to be cautious.

Here is a handy print out to keep with you or continue reading below.

What Are Supplemental Benefits?

A supplemental benefit is an item or service covered by a Medicare Advantage plan that is not covered by Original Medicare. Common supplemental benefits include:

- dental care

- vision care

- hearing aids

- gym membership

Supplemental benefits can be:

- Optional: They are offered to everyone enrolled in the plan. You can choose to purchase coverage if you want. For example, an optional dental benefit for which you can pay an extra premium.

- Mandatory: They are covered for everyone enrolled in the plan. For example, a gym membership benefit that’s included in the plan. You don’t pay an extra premium, and you can’t decline or opt out of the benefit. Mandatory doesn’t mean you need to use it, though.

Supplemental benefits must be primarily health related. There are some exceptions, though, for people with chronic conditions. See the following section for more.

Supplemental Benefits for Chronic Conditions

Plans can cover supplemental benefits that are not primarily health-related for enrollees who have chronic illnesses. These benefits can address social determinants of health for people with chronic disease. A social determinant of health is a part of someone’s life that can affect their health in some way. Examples of the kind of benefit that plans can cover are:

- Meal delivery

- Transportation for non-medical needs

- Home air cleaners

- Pest control

- Heart-healthy food or produce

To be eligible, you must be chronically ill. If you meet the criteria, a Medicare Advantage plan may offer you one of these benefits.

Note that not every member of a plan will have access to the same set of benefits. For example, a plan might cover services like home air cleaning and carpet shampooing for its members who have serious asthma. A member of that plan who doesn’t have asthma, or whose asthma is not as severe, will not have access to this coverage.

Questions to Ask a Medicare Advantage Plan

You might be interested in a plan that offers these supplemental benefits. If so, learn as much as possible before enrolling in the plan. It’s important to know exactly how a plan’s supplemental benefits work before signing up. Make sure to document calls and get information in writing. Ask questions like:

- Is this an optional benefit that I need to sign up for? Do I need to pay extra for it?

- Is the benefit only for people with chronic conditions? If so, do I meet the criteria?

- Are there limits to how much I can use this benefit?

- Are there restrictions on where and how I can access these services? For example, do I need to see in-network providers or get a referral first?

- Is this the most cost-effective way for me to access these services?

- Do the other parts of this plan’s coverage (not just the supplemental benefits) work for me? Are my providers in the plan’s network? Does the plan cover my drugs?

Look Out for Marketing Misrepresentation

Medicare has rules about how Medicare Advantage and Part D plans can contact you and market their services. It is a marketing violation to mislead Medicare beneficiaries when selling private plans. Marketing misrepresentation is a type of misleading marketing.

When it comes to supplemental benefits, remember that these are items and services that Original Medicare cannot cover. Each Medicare Advantage plan determines exactly what the benefit looks like—from how expansive or restrictive the coverage is, to the rules beneficiaries must follow to get coverage. When selling plans, agents or brokers should not mislead you into thinking that the plan’s supplemental benefits are more generous or less restrictive than they are.

The following are examples of marketing misrepresentation of Medicare Advantage supplemental benefits:

- An advertisement for the plan says that you would have access to the plan’s transportation benefit to help you get to appointments, when this benefit is not available to everyone—only to enrollees with chronic conditions.

- An agent tells you that your eye doctor is in network for the plan’s vision benefit, when you later learn that the doctor is not and never was in the plan’s network.

- An agent claims that the plan’s dental benefit covers fillings and dentures, when it really only covers regular cleanings and x-rays.

- An agent claims that Medicare covers hearing aids, when it doesn’t and hearing aids can be bought over the counter.

If you feel you have experienced misleading marketing, save all the information such as an agent’s business card, messages, marketing handouts, or other contact information. You should report this to your local Senior Medicare Patrol (SMP) or State Health Insurance Assistance Program (SHIP). Your SHIP can also help you switch plans if you enrolled based on misleading information. Contact information for your local SMP and SHIP.

The SHINE Medicare counseling team at the Area Agency on Aging for Southwest Florida serves at the local SMP and SHIP in southwest Florida.

Call us at 866-413-5337 or shineinfo@aaaswfl.org.

|

The Medicare Rights Center is the author of portions of the content in these materials but is not responsible for any content not authored by the Medicare Rights Center. This document is supported by the Administration for Community Living (ACL), U.S. Department of Health and Human Services (HHS) as part of a financial assistance award totaling $2,534,081 with 100 percent funding by ACL/HHS. The contents are those of the author(s) and do not necessarily represent the official views of, nor an endorsement, by ACL/HHS, or the U.S. Government.

|

Posted: October 8, 2025 by Leave a Comment

A Better Way to Manage Chronic Conditions

Living with a chronic condition? There’s a better way to manage it—and the Area Agency on Aging for Southwest Florida is here to help. Through its Living Healthy workshops, AAASWFL offers evidence-based programs developed by the Self-Management Resource Center (SMRC), designed to empower older adults and caregivers to take control of their health, reduce symptoms, and live fuller lives.

These small-group workshops are interactive, supportive, and led by trained facilitators who understand the challenges firsthand. Whether in person, online, or via Zoom, participants build practical skills and connect with others navigating similar journeys. Learn more.

To schedule a Living Healthy workshop at a facility near you, contact Clorivel Longoria, Health & Wellness / Elder Abuse Prevention Coordinator at (239) 652-6900 ext. 58226 or clorivel.lappost@aaaswfl.org.

Our free health and wellness workshops are available across the seven counties we serve in Southwest Florida, including Charlotte, Collier, DeSoto, Glades, Hendry, Lee, and Sarasota. Visit our event calendar for upcoming dates and locations.

Posted: October 1, 2025 by Leave a Comment

Medicare Minute: Medicare Advantage Supplemental Benefits

Medicare Advantage Plans may try to tempt you with a variety of supplemental benefits—or things that Original Medicare can’t cover. These supplemental benefits can be extremely helpful, or they can end up being disappointing and misleading. In this Medicare Minute we’ll share what to look for when considering supplemental benefits and when to be cautious.

Here is a handy print out to keep with you or continue reading below.

What Are Supplemental Benefits?

A supplemental benefit is an item or service covered by a Medicare Advantage plan that is not covered by Original Medicare. Common supplemental benefits include:

Supplemental benefits can be:

Supplemental benefits must be primarily health related. There are some exceptions, though, for people with chronic conditions. See the following section for more.

Supplemental Benefits for Chronic Conditions

Plans can cover supplemental benefits that are not primarily health-related for enrollees who have chronic illnesses. These benefits can address social determinants of health for people with chronic disease. A social determinant of health is a part of someone’s life that can affect their health in some way. Examples of the kind of benefit that plans can cover are:

To be eligible, you must be chronically ill. If you meet the criteria, a Medicare Advantage plan may offer you one of these benefits.

Note that not every member of a plan will have access to the same set of benefits. For example, a plan might cover services like home air cleaning and carpet shampooing for its members who have serious asthma. A member of that plan who doesn’t have asthma, or whose asthma is not as severe, will not have access to this coverage.

Questions to Ask a Medicare Advantage Plan

You might be interested in a plan that offers these supplemental benefits. If so, learn as much as possible before enrolling in the plan. It’s important to know exactly how a plan’s supplemental benefits work before signing up. Make sure to document calls and get information in writing. Ask questions like:

Look Out for Marketing Misrepresentation

Medicare has rules about how Medicare Advantage and Part D plans can contact you and market their services. It is a marketing violation to mislead Medicare beneficiaries when selling private plans. Marketing misrepresentation is a type of misleading marketing.

When it comes to supplemental benefits, remember that these are items and services that Original Medicare cannot cover. Each Medicare Advantage plan determines exactly what the benefit looks like—from how expansive or restrictive the coverage is, to the rules beneficiaries must follow to get coverage. When selling plans, agents or brokers should not mislead you into thinking that the plan’s supplemental benefits are more generous or less restrictive than they are.

The following are examples of marketing misrepresentation of Medicare Advantage supplemental benefits:

If you feel you have experienced misleading marketing, save all the information such as an agent’s business card, messages, marketing handouts, or other contact information. You should report this to your local Senior Medicare Patrol (SMP) or State Health Insurance Assistance Program (SHIP). Your SHIP can also help you switch plans if you enrolled based on misleading information. Contact information for your local SMP and SHIP.

The SHINE Medicare counseling team at the Area Agency on Aging for Southwest Florida serves at the local SMP and SHIP in southwest Florida.

Call us at 866-413-5337 or shineinfo@aaaswfl.org.

The Medicare Rights Center is the author of portions of the content in these materials but is not responsible for any content not authored by the Medicare Rights Center. This document is supported by the Administration for Community Living (ACL), U.S. Department of Health and Human Services (HHS) as part of a financial assistance award totaling $2,534,081 with 100 percent funding by ACL/HHS. The contents are those of the author(s) and do not necessarily represent the official views of, nor an endorsement, by ACL/HHS, or the U.S. Government.

Posted: August 28, 2025 by Leave a Comment

Medicare Minute: Medicare’s Open Enrollment Period

Open Enrollment is right around the corner! It runs October 15 through December 7 and is the time of year when you can make certain changes to your Medicare coverage. The last change you make will take effect on January 1. Take action during Open Enrollment to make sure your coverage will meet your needs in 2026.

Making Changes During Medicare’s Open Enrollment

The changes you can make include:

Call 1-800-MEDICARE (633-4227) or visit Medicare.org to make changes.

Review Your Coverage for 2026

Medicare Advantage and Part D plans usually change each year. Make sure that your drugs will be covered next year and that your providers and pharmacies will still be in the plan’s network.

Original Medicare: Visit www.Medicare.gov or read the 2026 Medicare & You handbook to learn about Medicare’s benefits for the upcoming year.

Medicare Advantage or Part D Plan: Read your plan’s Annual Notice of Change (ANOC) and Evidence of Coverage (EOC).

Considerations When Choosing a New Plan

Ask yourself the following questions before choosing a Part D drug plan:

Ask yourself the following additional questions before choosing a Medicare Advantage plan:

You can use Medicare’s Plan Finder tool to compare plans. Access Plan Finder by going online to www.Medicare.gov/plan-compare or by calling 1-800-MEDICARE (1-800-633-4227)

Download a convenient handout with tips on choosing a new plan and protecting yourself from marketing violations and Medicare Fraud.

Need local help?

SHIP|SMP toll free: 866-413-5337

shineinfo@aaaswfl.org

The Medicare Rights Center is the author of portions of the content in these materials but is not responsible for any content not authored by the Medicare Rights Center. This document is supported by the Administration for Community Living (ACL), U.S. Department of Health and Human Services (HHS) as part of a financial assistance award totaling $2,534,081 with 100 percent funding by ACL/HHS. The contents are those of the author(s) and do not necessarily represent the official views of, nor an endorsement, by ACL/HHS, or the U.S. government.

Last Updated: August 28, 2025 by Leave a Comment

Suicide Prevention in Lee County: A Call to Connection and Compassion

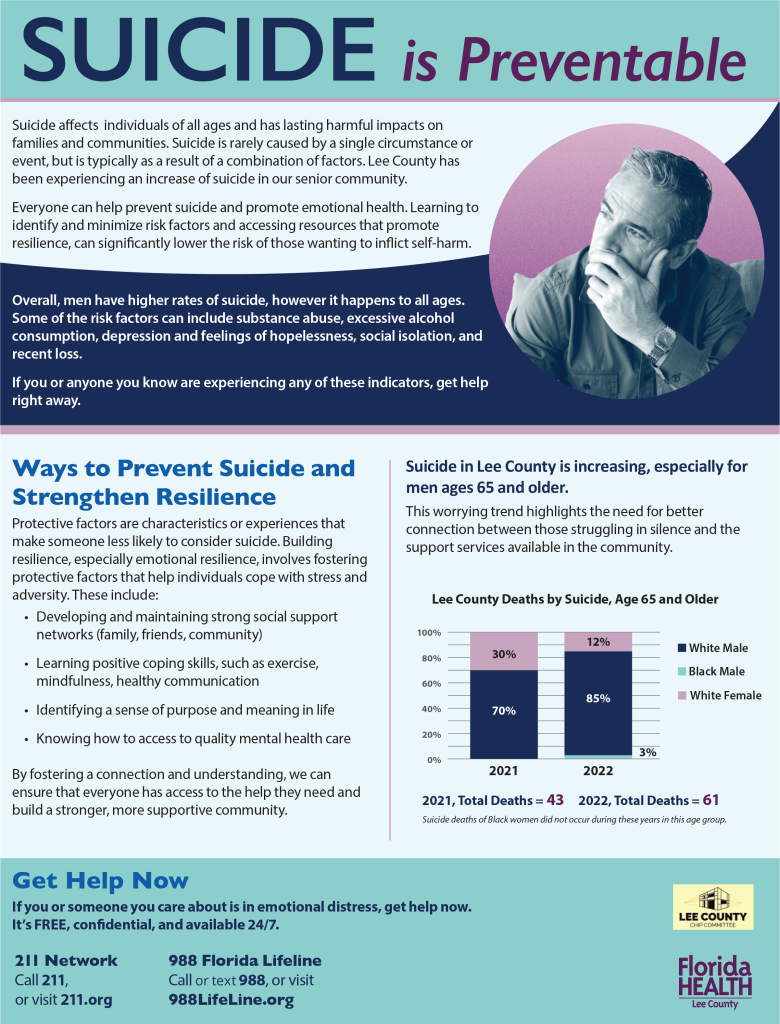

Suicide is a deeply complex issue that affects individuals, families, and entire communities. In Lee County, recent data reveals a troubling rise in suicide rates—particularly among men aged 65 and older. This trend underscores the urgent need for compassionate outreach, culturally responsive messaging, and stronger community connections.

At AAASWFL, we believe that suicide is preventable. Through education, awareness, and access to support, we can help older adults and caregivers navigate emotional distress and build resilience.

Florida Health and the Lee County CHIP Committee have made valuable local data and a resource guide including warning signs, risk factors and how to get help available for the public and providers. (Available for download.)

What the Data Tells Us

Between 2021 and 2022, suicide deaths among older adults in Lee County increased by over 40%, with white males representing the highest proportion of cases. While suicide affects people of all backgrounds, older adults—especially those facing isolation, chronic illness, or grief—are particularly vulnerable.

These numbers are more than statistics. They represent lives lost, families grieving, and missed opportunities for intervention.

Recognizing Risk Factors

Suicide is rarely caused by a single event. It often stems from a combination of factors, including:

By recognizing these warning signs, caregivers, service providers, and community members can take meaningful steps to offer support.

Building Resilience and Protective Factors

Resilience isn’t just about “bouncing back”—it’s about creating a foundation of emotional strength and connection. Protective factors that reduce suicide risk include:

Whether you’re a caregiver, neighbor, or professional, fostering these protective factors can make a life-saving difference.

How You Can Help

Starting a conversation can be the first step toward healing. If you know someone who may be struggling, reach out. Listen without judgment. Share resources. Your compassion could be the bridge to hope.

Help is available 24/7, free and confidential

Call 211 or visit 211.org

Call or text 988 or visit 988LifeLine.org

Together, we can build a more connected, resilient Southwest Florida.

Public handout for download.

Provider handout for download.

Posted: August 26, 2025 by Leave a Comment

Empower Your Voice: Advocate for Arthritis Awareness and Support

Living with arthritis isn’t just a personal journey—it’s a community issue that deserves attention, action, and advocacy. Whether you’re a caregiver, a person living with arthritis, or simply someone who wants to make a difference, your voice matters.

The Arthritis Foundation’s Advocacy 101 guide is a powerful starting point for anyone ready to speak up. It breaks down the basics of grassroots advocacy, showing how everyday citizens can influence policies, improve access to care, and support research for better treatments. From contacting elected officials to sharing your story, this resource makes advocacy approachable and impactful.

But advocacy is just one part of the journey. Staying informed and living well with arthritis is equally important. The Healthy Living section of the Arthritis Foundation offers practical articles on nutrition, exercise, pain management, and more. Whether you’re exploring joint-friendly workouts or learning about treatment options, these resources are designed to support your well-being every step of the way.

At AAASWFL, we believe in empowering individuals and caregivers with tools that make a real difference. Visit the links above to learn, advocate and take action for a healthier future.

Last Updated: August 18, 2025 by Leave a Comment

Our Third Annual Community Resource Fair is Almost Here!

Our annual community resource fair is back! Last year we had an incredible turnout from the community and we hope to see old and new faces alike this year.

Unfamiliar with our popular annual free event?

The Area Agency on Aging for Southwest Florida (AAASWFL) proudly invites older adults, adults with disabilities, and caregivers to its third annual Community Resource Fair—an event designed to connect attendees to vital services and support. This year it will be held on Friday, September 12, 2025, from 10:00 a.m. to 12:00 p.m. at our offices in Fort Myers, 2830 Winkler Avenue, Suite 112.

Attendees will have the opportunity to engage with a wide range of exhibitors offering free resources and expert guidance. Lee Health will be on-site providing balance screenings, and SHINE counselors will be available to assist with Medicare questions. AAASWFL’s information and referral staff will also be present to help connect attendees with local services.

The Alzheimer’s Association’s Brain Bus, a mobile exhibit focused on dementia education and awareness, will be on-site. Additional exhibitors include Florida Power & Light (FPL), sharing tips on lowering utility costs, and Sam’s Club, offering membership opportunities, and many more!

Free raffle prizes will be drawn throughout the event, including exciting donated items like Ring Doorbells and Echo Shows.

If you plan to attend AAASWFL’s 2025 Community Resource Fair, please complete this brief Event Registration Form.

Last Updated: August 13, 2025 by Leave a Comment

Move More, Hurt Less: Free Arthritis-Friendly Exercise Program – Special Kickoff Event with HSS at NCH in Naples

If you or someone you love is living with arthritis, joint pain, or mobility challenges, the Area Agency on Aging for Southwest Florida (AAASWFL) offers free evidence-based exercise program designed specifically for adults aged 60 and older across Southwest Florida. In September, we will be partnering with HSS at NCH to offer this program in Naples and it kicks off with a special event you won’t want to miss.

What Is the Arthritis Foundation Exercise Program?

The Arthritis Foundation Exercise Program (AFEP) offers gentle, joint-safe movements that can be done seated or standing. Led by trained instructors, these sessions help improve flexibility, reduce pain, and boost overall well-being. Whether you’re managing arthritis or simply looking for a safe way to stay active, AFEP is a welcoming and effective option.

Kickoff Event Details

Join us for a fun and informative launch event where you can preview the program, meet the team, and explore cutting-edge wellness tools.

Date: Saturday, September 27, 2025

Time: Arrive at 8:45 AM Program runs 9:00–9:45 AM

Location: HSS at NCH, 11190 Health Park Blvd, Building 2, Naples, FL

What to Expect

Why It Matters

Staying active is one of the best ways to manage arthritis and maintain independence. This program is completely free, open to the public, and tailored to meet the needs of older adults in our community.

How to Register

Call our health and wellness specialist, Gloria Longoria, at 239-652-6914 to reserve your spot. Space is limited, so don’t wait!

Let’s move toward better health — together.

Posted: August 6, 2025 by Leave a Comment

Medicare Current Beneficiary Survey

In June 2025, CMS released the MCBS – Overview Infographic, providing a quick reference guide on the Medicare Current Beneficiary Survey (MCBS). Conducted by NORC at the University of Chicago, this ongoing study aims to gather valuable information from Medicare beneficiaries.

Note that beneficiaries may be contacted by NORC on behalf of CMS, which is an exception to usual guidelines. For further details, and to verify the study and the interviewer, refer to the following:

Thank you for participating!

Posted: July 29, 2025 by Leave a Comment

Medicare Minute: Choosing Between Original Medicare and Medicare Advantage

People with Medicare often wonder whether to choose Original Medicare or a Medicare Advantage Plan. Learn the key differences to help you choose the best option for your needs.

Original Medicare

The traditional program offered directly through the federal government.

Medicare Advantage

Private plans that contract with and receive payment from the federal government to provide Medicare benefits.

You may choose one option and later decide to try the other. Be aware that there are limitations on when you can make these changes. Your Medigap (supplement to Original Medicare) options may be more limited outside of the first 6 months that you’re enrolled in Medicare after the age of 65.

Click here to download a table that compares Original Medicare and Medicare Advantage by costs, Medigap supplement insurance, provider access, referrals, drug coverage, Medicare Advantage supplemental benefits, and Out-of-pocket limits.

Remember that there are several different kinds of Medicare Advantage plans. If you’re interested in joining a plan, speak to a plan representative to learn more.

Watch Out for Misleading Marketing

Health insurance companies try to reach people in various ways, like television commercials, radio ads, events, mailings, phone calls, and texts. The Centers for Medicare & Medicaid Services (CMS) has rules for how companies can sell Medicare Advantage plans and Part D plans. These rules protect Medicare beneficiaries from aggressive or misleading marketing.

Before you enroll in a plan, make sure you understand:

An agent or broker should never pressure or mislead you into joining a plan. They should also never offer gifts to sign up or say they were sent by Medicare or Social Security. If you feel an insurance agent has pressured or misled you, you should save all their information. This might include:

You should report this to your local Senior Medicare Patrol (SMP) or State Health Insurance Assistance Program (SHINE). Your SMP or SHINE Medicare counselors can help you review the concern and report it to CMS as a potential marketing violation. Contact information for your local SMP and SHINE teams by calling 866-413-5337 or emailing shineinfo@aaaswfl.org.

Your local SHINE counselors can also help you seek a Special Enrollment Period (SEP) to switch plans if you are misled into a plan that does not cover the services you need.

Who to contact for help:

The Medicare Rights Center is the author of portions of the content in these materials but is not responsible for any content not authored by the Medicare Rights Center. This document is supported by the Administration for Community Living (ACL), U.S. Department of Health and Human Services (HHS) as part of a financial assistance award totaling $2,534,081 with 100 percent funding by ACL/HHS. The contents are those of the author(s) and do not necessarily represent the official views of, nor an endorsement, by ACL/HHS, or the U.S. government.

search this site

popular pages

AAASWFL Programs & Services